Iso 20022 manual#

We can group the benefits of ISO 20022 adoption into three areas: enabling automation, improving compliance and fraud prevention, and improved customer insights.īy standardizing how data is structured and collected, payment agents can streamline invoice and payment processing, requiring fewer manual interventions and enabling faster payment reporting. We’re seeing customers uncover opportunities for more transparency, more automation, and new services, all fueled by the richer intelligence encased in the ISO 20022 format-the benefits extend far beyond compliance.

Iso 20022 how to#

Including ISO 20022 as part of a broader modernization strategy not only creates paths for financial services organizations to convert to the new standard, it opens opportunities for organizations to assess how to unlock the value of new, higher quality payments data.

We’re also seeing many of our own customers incorporate ISO 20022 adoption as part of ongoing investments to modernize legacy systems across their data estate.

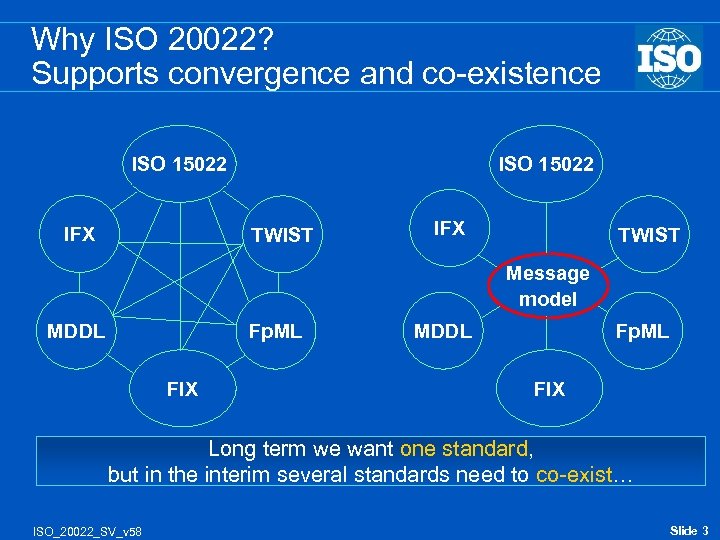

According to SWIFT, already used by payment systems in over 70 countries, in the coming years it will be the de facto standard for high-value payment systems of all reserve currencies, supporting 80 percent of global volumes and 87percent of value transactions worldwide. Regional rails, such as those in the UK, US, Canada, Australia, etc., are also following suit and developing mandates to incorporate ISO 20022 as part of their faster payment rails like low-value peer to peer and business transactions. SWIFT has mandated that all banks leveraging SWIFT-that is, all actors sending and receiving wire payments-need to have adopted ISO 20022 by November 2022 for incoming wires, and by 2025 for outgoing wires. Of course, the value of standards can only be realized inasmuch as it is widely adopted. Herein lies another defining characteristic of ISO 20022: it can also act as an interoperability hub between different standards. Adopting a common dictionary and a common standard is expected to introduce significant efficiencies for domains that manage payment processing systems and regulatory reporting, which have historically operated with vastly different standards and information formats. The expanded dictionary of data will enable messages to provide information related to payment roles (debtors, creditors, other agents), business processes (currency, execution and settlement dates, remittances), as well as descriptive data needed for business activities (purpose of payment, type of transaction). It will increase the units of data for payment messages from just over 100 characters to approximately 9000 characters, significantly augmenting the amount of data that accompanies and provides context to a payment message. ISO 20022 is a machine-readable XML format that allows users to define tags and data types for each component of a message. Moreover, in industries such as financial services, where trust, interoperability, and compliance are top of mind for customers, standardization can enable greater efficiency for ensuring compliance with information regulations and in preventing financial crime. When widely adopted across an industry, across regions, and across their interacting agents, standards play a foundational role in enabling users to unlock the value by enabling greater automation, delivering new insights, and facilitating more efficient collaboration. Data standards govern what data is collected, how it is structured, and what that data means. With data being hailed as the new currency, we’re seen growing attention to data standards across regions and industries. At the center of this wave of data standardization is an opportunity for banking customers to unlock greater value across payment chains and rethink how they can leverage data to better serve their customers.

Though many organizations are approaching ISO 20022 adoption as a compliance exercise, the potential value of ISO 20022 extends far beyond regulatory demands. As payment data is the lifeblood of the banking industry, this introduction of this standard is a substantial milestone in the digitalization of payments. Emerging global payment standard ISO 20022, put forth by the ISO technical committee responsible for the fields of banking and financial services, aims to create a common language and model for payments data, one that can be applied by any agent in the industry and implemented across any network.

0 kommentar(er)

0 kommentar(er)